A war in the making

TVL (total value locked) is arguably the most important metric when assessing a DeFi protocol, as they fight to be #1 in this metric shows yield farmers where to deposit their crypto assets.

Curve has the largest DeFi TVL and it started out primarily as a DEX for stable swaps. The idea was to provide traders with a platform where they could reliably trade like-for-like assets (USDC, USDT, DAI etc.) at extremely low slippage and low fees as opposed to general-purpose DEXes like Uniswap, whose algorithm isn’t optimized for such trades.

Stablecoins make up 4 of the top 25 cryptocurrencies by market cap and as crypto becomes more widely adopted across the globe, regulation will help craft an emergence of decentralised alternatives and increased demand for stablecoin liquidity.

Why does low slippage matter?

Slippage is the difference between the exchange rate you expect to receive vs the only you actually receive. With low liquidity pools, there is a large margin between these and ultimately, the higher the slippage, the less you actually end up receiving. This combined with Curve’s low fees makes depositing stable coin liquidity on their platform a highly attractive option.

For those that deploy their liquidity onto Curve, liquidity providers earn a % of fees in the native token $CRV. Furthermore, those that earn $CRV have the option to lock this up to receive $veCRV (vote escrowed Curve) which is a governance token, used to provide a vote in whatever important matter has been proposed for Curve. For instance, this could be used to vote upon: different pools within Curve or each pool’s gauge weight (more on this later).

The holders of veCRV are able to receive “bribes” from protocols in return for voting for a protocol’s pool. The ultimate end goal in all of this is for their coin or protocol to be number one, with the most traffic directed their way and the way this is done is to attract the highest yield and subsequently, the highest TVL. This is where the gauge comes in.

Each week, veCRV holders vote on where the next set of CRV emissions will be directed to. This is called Gauge Weights, so, in order to encourage users to provide liquidity to a protocol’s specific pool, they will use CRV emissions as an incentive.

LPs will receive their share of the standard trading fees, but if they are smart, they also lock CRV for as long as possible and vote for the next round of emissions to be directed to the pool they are providing liquidity to.

Using abracadabra.money as an example

Abracadabra.money ($SPELL) is a DeFi project that allows users to deposit collateral and to take out a loan of Magic Internet Money (MIM) which is an algorithmically-pegged stablecoin. This protocol needs incredibly deep liquidity as MIM is minted and burnt in order to maintain its $1 peg. Deep liquidity ensure that if a whale came along and sells a boat-load of MIM it doesn’t affect the price of the asset as much and hence does not take it off-peg.

So how can they ensure this deep liquidity?

They could buy up a lot of CRV, lock it for 4 years, and then sway the vote to ensure that the majority of emissions are going towards the MIM3Pool.

However, a more cost-effective way to ensure the incentives are steered in the right direction is to bribe veCRV holders individually, or better yet, the largest holder of veCRV… Convex.

Why go through the hassle of getting it yourself, if you can simply get users to give their veCRV to you? This is what Convex figured out.

Those who stake their CRV on Convex receive cvxCRV, a token which holds no voting rights but provides additional yield from trading fee rewards. Moreover, users can lock up their CVX to receive vlCVX. This allows holders to vote on decisions that affect the Convex protocol, primarily, on issues pertaining to Convex’s supply of veCRV.

Curve, Convex and Bribes

Going back to the methods of ensuring deep protocol liquidity, projects such as abracadabra.money have the option bribe veCRV holders (on both CRV/CVX) into voting for their pool when the next series of emissions are released. Protocols can put up a set amount of their native token (i.e. SPELL) to encourage veCRV holders to vote in favour of the MIM pool. This way, veCRV holders who vote for the MIM pool are paid on top of their regular rewards in SPELL, for example.

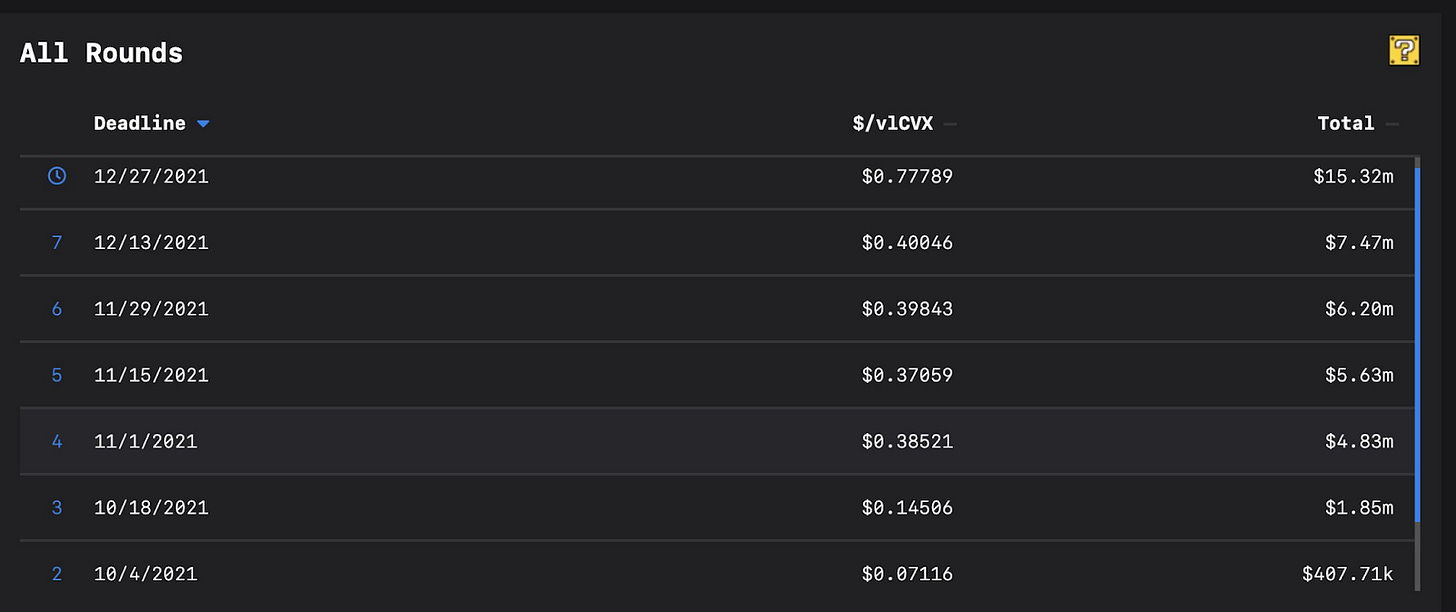

The image below highlights the exponential growth in Convex bribing emissions.

So, the Curve Wars ensues: those controlling the veCRV vote, control the emissions, which results in deeper liquidity for their product. Even though it may seem that the Curve wars have gone on for some time, they will only become more and more intense as DeFi continues to grow and evolve. So how can one position themselves to profit from this emerging narrative?

Redacted Cartel

The [Redacted] Cartel is an OHM fork (lol, kek, wen 0?) that aims to become a blockhole for meta governance tokens within the most important DeFi ecosystems.

$BTRFLY began with a treasury capital raising event where users could bond $CRV, CVX or $OHM for discounted $BTRFLY.

With enough tokens in the treasury (their treasury balance on the day of launch was $73,267,961!), $BTRFLY has the potential to become a veCRV "meta-token". [Redacted] has the potential to calibrate the veCRV vote share by accumulating CRV/CVX into its treasury.

75% of their $CVX has gone to locked $vlCVX which will earn bribes from those voting. Similarly, $BTRFLY can effectively become $veCRV circulating supply, essentially being buyable votes. This translates into liquidity for $BTRFLY.

The [Redacted] Cartel may be the first OHM that moves from simply forking Olympus to providing a whole new level of value accrual for it’s holders by positioning itself as the first mover in acquiring the largest collective share of all governance tokens. It is effectively a leveraged long on the Curve wars and similar to how Convex can act as a leverage voting strategy for Curve emissions, the price of $BTRFLY will reflect the demand to any and all influential governance votes within the most critical DeFi ecosystems!

$XBE finance

The Curve Wars have shown that whether a retail investor or a crypto VC, participants are always on the hunt for the highest yield. In recent years, corporate cultures have shifted towards one of financialisation and practices that maximise returns to their shareholders. $xbE Finance is uniquely positioned to cater to both retail and institutional investors.

The XBE protocol is to bridge institutional and decentralised finance. It tokenizes bonds and securities to be the institutional investment onramp into Defi. It currently is one of the only bridges between TradeFi and Defi and utilises institutional funds to invest in yield strategies across DeFi to maximize profits.

One of the reasons for Convex’s popularity was the ability to offer additional yield to veCRV holders. $xbE uniquely caters to multiple market participants through a complementary offering of different products.

The XBE Hive is a yield complementary product building on Convex and Curve. People can deploy their capital into XBE, who then deploys this into Convex and finally into Curve. This allows you to earn CRV, CVX and XBE.

The XBE Hive Pro is an institutional application designed for licensed financial service providers that manage customer funds to offer their customers access to DeFi through regulatory compliant structures.

Tokenising securities: Imagine taking your $AAPL position, tokenizing it into an NFT, and then leveraging it for Yield and Liquidity. This a multi-billion/ trillion dollar market and XBE will be one of the first movers.

So why is earning yield in the form of the $XBE token valuable?

$XBE uses a CRV/veCRV model where $XBE is governance of the DAO and stakers split the protocol fees. Currently, only 12k tokens are in circulation with a total supply of 40k to be released over the next 2 years. Furthermore, XBE has 3 revenue streams:

Protocol fees - Institutions funnel tokenised cash into the product by minting xbEURO (a stable coin pegged to 1 Euro) of which a 5% fees is charged.

Institutional Vault (XIV) Returns - Institutional money flows into the vaults, it’s invested in yield strategies or partner LP’s, and returns are used to buy back xbE on the open market and distribute to holders.

Surplus yield from other farming strategies (more to come from the team later)

In 2021, $500m of institutional money was pledged to access DeFi yields with companies such as Santander and Goldman Sachs taking part in this.

$500M in the vault we estimated will earn us around $3,673 per year, per xbE. On top of those yearly rewards, you will also get the price appreciation of the xbE token. Normally, a conservative price-to-earnings ratio for crypto is 10x. You do the maths!

Final thoughts

As @cobie best described, participating in a crypto bull-run is more akin to playing video games than it is investing due to video games' ever-evolving metagame. 2021 saw a narrative of metagames and capital rotation that spanned DeFi 1.0, memecoins, play-to-earn, GameFi, $OHM forks and the metaverse. The most successful participants traded the metagame ahead of the meta, this article aims to educate those new to DeFi and to help them understand synergies around the most crucial areas of the ecosystem in order to help them be amongst the first movers of the new crypto meta-game.